When companies consider implementing e-Business they need to understand that there are several factors steering the adoption of e-Business. Adoption is the process during which an enterprise becomes capable of transacting electronically.

The adoption process starts with acquiring knowledge of e-Business concepts and exploring the solutions available on the market. During an interactive awareness workshop stakeholders will learn more about e-Business models and trends.

In the next step organizations form an attitude toward the behavioral intent to pursue or reject e-Business. This requires understanding the factors that influence the “Intent to Adopt” of companies and their trading partners. Gaining more insights in the magnitude and impact of these factors improves decision-making.

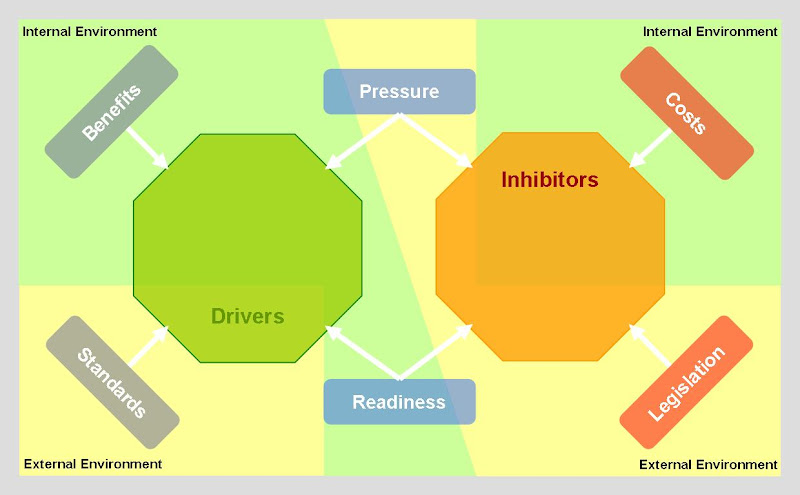

The most significant factors driving and inhibiting the intent to pursue or reject adoption of e-Business are perceived benefits, external pressure, perceived costs and organizational readiness. These factors emerge from the internal and external business environments of organizations and have different effects on decision-making.

Perceived benefits and perceived costs relate to the anticipated economic and strategic advantages and disadvantages. The more the perceived benefits outweigh the perceived costs the more likely decision-makers are willing to consider adoption. Likewise, the more perceived costs outweigh perceived benefits, the less likely decision-makers will pursue adoption.

Moreover, even though there is a considerable amount of evidence that benefits exceed costs, companies may still be reluctant to adopt due to an apparent lack of organizational readiness.

On the other hand when decision-makers face extreme external pressure that may affect the well-being of the company they become increasingly vulnerable to adopt.

When overlooking these considerations there are good reasons for organizations to examine and evaluate the characteristics of drivers and inhibitors more in depth.

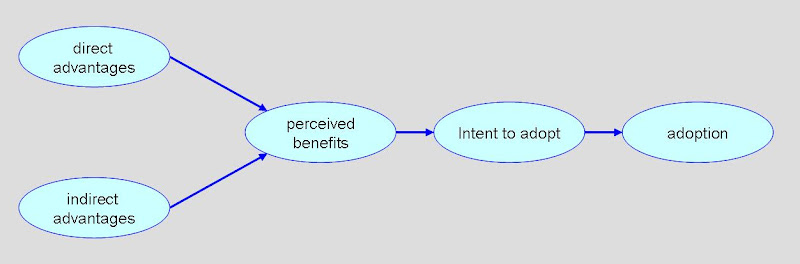

Perceived Benefits

Perceived Benefits are the perceptions of managers and the level of recognition by decision-makers of the relative advantages that e-Business can provide their organization. These relative advantages are considered predictors of the intent to adopt. They represent the degree to which an organization believes that value can be created. Value creation takes place on strategic and operational level.

There are two main types of Perceived Benefits, which can be categorized as direct and indirect advantages or benefits.

1) Direct advantages refer to immediate and tangible benefits that companies would enjoy by using e-Business such as reduced transaction costs and efficiency improvements.

Examples:

- Reducing manual paper handling and data entry leads to time savings.

- Reducing postage and storage needs leads to cost savings.

2) Indirect Advantages refer to less tangible (intangible) benefits that are difficult to justify and measure. These are mostly opportunities that result from the impact of changing business processes and relationships, such as improved interfirm relationships, better business control and increased ability to compete.

Examples:

- Strengthening of customer relations leads to long-term partnerships.

- Closer collaboration between supplier and buyer leads to improved customer loyalty.

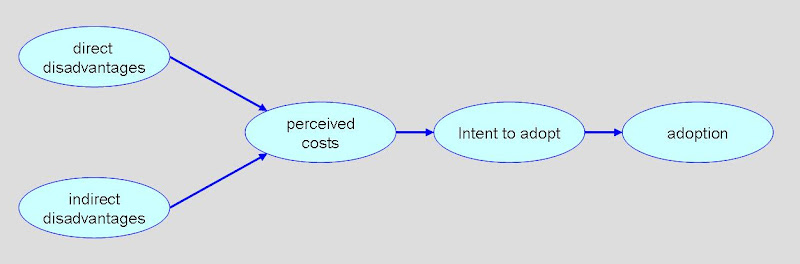

Perceived Costs

Perceived Costs are the perceptions of managers regarding the relative disadvantages of e-Business for the organization. These relative disadvantages are inhibitors of the intent to adopt. They strengthen the concerns of decision-makers about the value e-Business brings on short term.

There are two main types of Perceived Costs, which can be categorized as direct and indirect disadvantages or costs.

1) Direct disadvantages refer to immediate and tangible costs that companies would incur when adopting e-Business. The tangible costs address the parts of an investment which decision-makers can easily identify and attach a quantifiable value to such as implementation and operation costs.

Examples

- Installation and integration costs.

- Cost of trading partner on-boarding management.

2) Indirect disadvantages refer to less tangible (intangible) costs that are difficult to identify and measure, such as the cost of unexpected downtimes and the cost of non-compliance with government legislations and industry regulations. These intangible costs are often closely related to actions that should be taken to ensure business continuity and to rapidly respond to changing conditions.

Examples

- Demand for increased effort and resources to support both new and existing practices.

- Risks of constantly having to adapt to changing business needs and technological requirements.

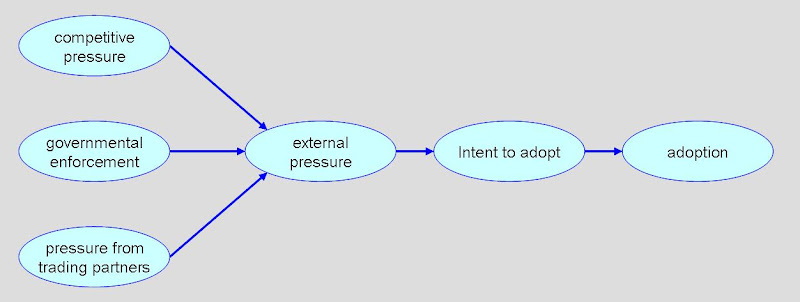

External Pressure

Over the last years External Pressure has become a significant determinant for the intent to adopt. Beyond the walls of an organization there are several types of pressure that encourage companies to achieve adoption. These types of pressure are competitive pressure, governmental enforcement and pressure from trading partners.

Competitive pressure is

Organizational Readiness

When looking at readiness organizations should realize it is not quite as simple as just being able to receive and send business documents electronically.

Organizations have to research and understand what motivates and de-motivates companies and decision-makers. Making informed decisions based on a foundation of knowledge and sound reasoning will determine the success of the business.

Organizations must learn and understand the enabling and restraining forces behind the adoption of e-Business.

The impact of Interrelationships between drivers and inhibitors on adoption

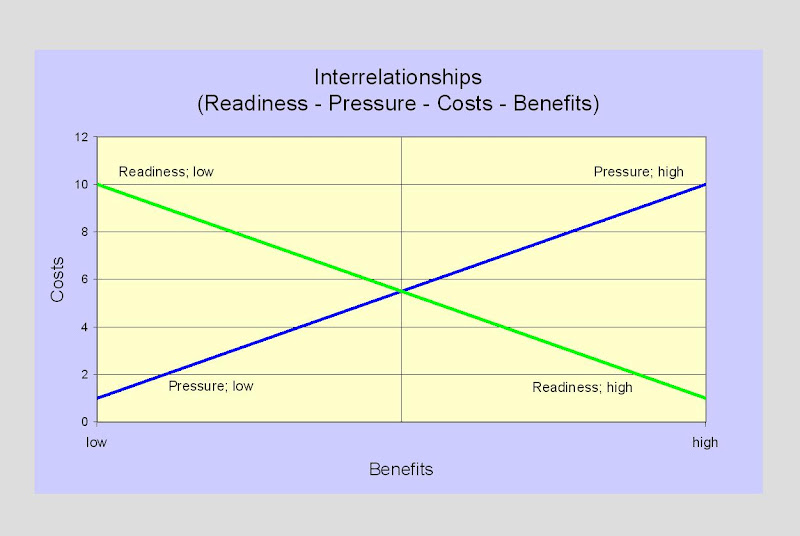

Apart from understanding the influence of these factors on the intent to adopt it is important to assess the nature and extent of the interrelationships between drivers and inhibitors.

These interrelationships and their effects on decision-making are the most significant determinants for adoption of e-Business. They dictate how the key drivers and inhibitors influence the attitude of decision-makers. When assessing the interrelationships companies will discover their main drivers and inhibitors.

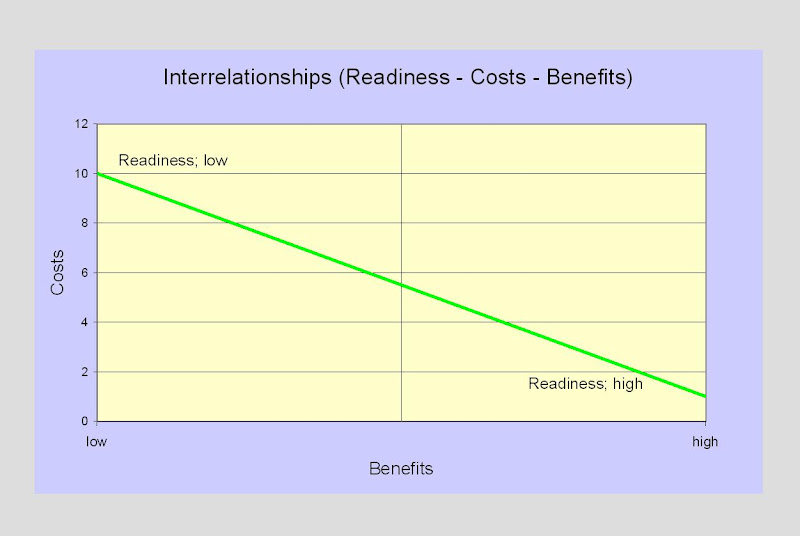

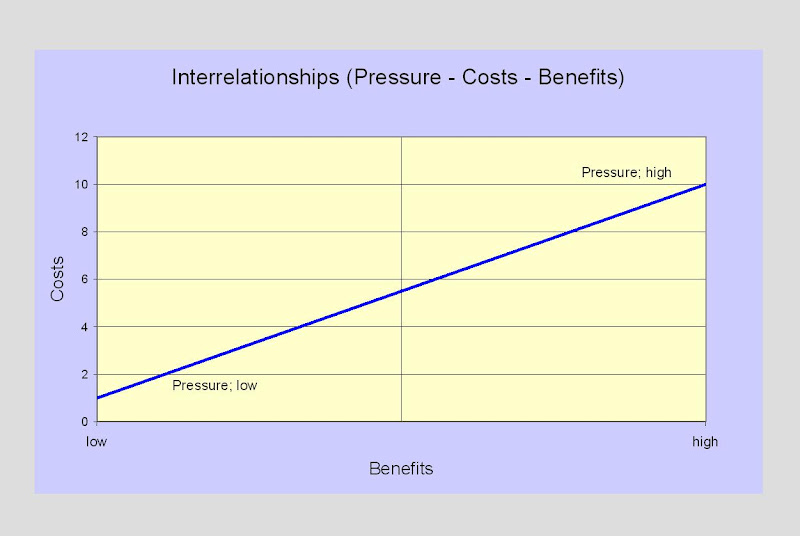

The two most important relations to evaluate are Readiness - Costs - Benefits and Pressure - Costs - Benefits.

1) Readiness - Costs – Benefits

Companies that have a high level of Organizational Readiness in terms of information technology need only low investments to gain high benefits.

2) Pressure - Costs – Benefits

Companies that experience high competitive pressure and/or pressure from trading partners are more likely to invest to obtain or maintain high indirect advantages - benefits - opposed to other firms.

These interrelations show that Readiness and Pressure are key drivers and impediments of the intent to adopt while Costs and Benefits form the main constraints to decision-making behavior.

This analysis leads to the conclusion that without pressure companies feel no need to look at implementing e-Business and without some degree of Enterprise Maturity organizations will not be able to respond to pressure. As such a minimum level of pressure and readiness is needed and required to establish a positive attitude to pursue or reject adoption.

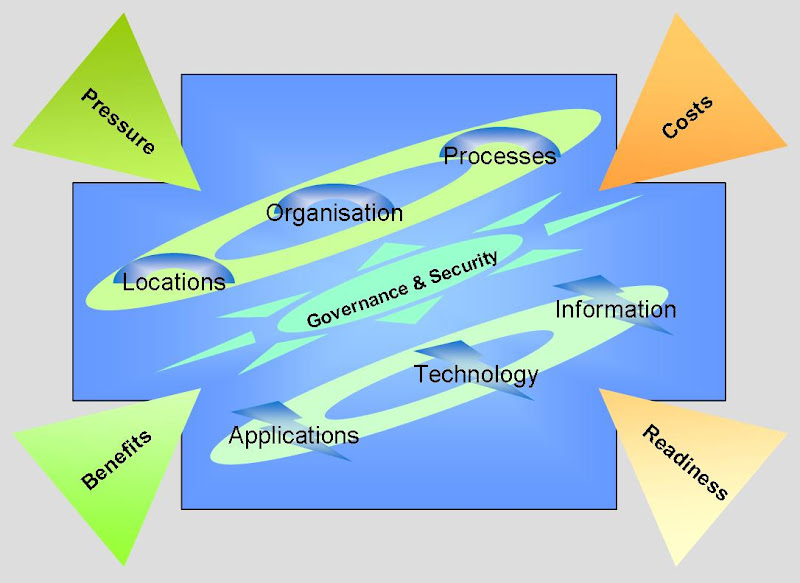

Determine the maturity of the Enterprise Architecture of the firm

Upon exploring the effects of interrelationships on decision-making organizations will find Organizational Readiness the main factor influencing the intent to adopt. Organizational Readiness refers to the level of technology currently incorporated into business processes.

For determining the readiness of an organization companies need to assess the maturity of their current Enterprise Architecture. The Enterprise Architecture provides the framework for achieving interoperability within the enterprise and across enterprises.

Interoperability is the ability of information systems to seamlessly exchange data between enterprises, to process and understand the meaning and purpose of exchanged data, and to enable business processes and software applications to interact.

There are different forms (types) of interoperability that strengthen the capabilities of the Enterprise Architecture elements. Two such types of interoperability are directly related to elements of the Enterprise Architecture:

* Information Interoperability – Information Architecture – is the ability to exchange information in a uniform manner across multiple organizations as such that the precise meaning of exchanged information is understandable by separately developed applications.

* Business Interoperability – Business Architecture – is concerned with establishing business relationships, aligning and streamlining business processes, reviewing and revising working procedures, and setting up and formalizing cooperation agreements.

The other type of interoperability, Technical Interoperability, relates to the system and integration architectures. Technical Interoperability is concerned with the connectivity of systems and applications for the purpose of exchanging information with focus on the conveyance of data, not on its meaning.

These key Enterprise Architecture elements and Interoperability types form the base criteria for the maturity level classification scheme, called the e-Business maturity ladder. The maturity ladder contains five maturity levels and provides insights as well as guidance on the future direction in e-Business, including realization of benefits.

technological and business domain of their Enterprise Architecture. These domains encompass three main types of interoperability which determine for the greater part how ready the organization is:

* Business processes - process interoperability relates to the Business Architecture.

* Information - data and semantic interoperability relates to the Information Architecture.

* Systems and applications - technical interoperability relates to the Application Architecture.

Additionally there is the level of integration already supported by the enterprise - the Integration Architecture - consisting of Enterprise Application Integration and Inter-Enterprise Integration. Integration describes to what extent connections are implemented internally between different systems and externally with trading partners, suppliers and customers.

Together these types of interoperability and levels of integration form the base criteria for the maturity level classification scheme, the e-Business Maturity Ladder. The e-Business Maturity Ladder contains five maturity levels and provides insights as well as guidance on the future direction in e-Business, including realization of benefits.

Again the maturity of the Enterprise Architecture provides the foundation for Organizational Readiness and forms the basis for responding to External Pressure.

The base criteria for classifying the maturity are:

1. Business Architecture

2. Information Architecture

3. Application (System) Architecture

4. (Internal) Integration Architecture

5. (External) Integration Architecture

Guidance on future direction

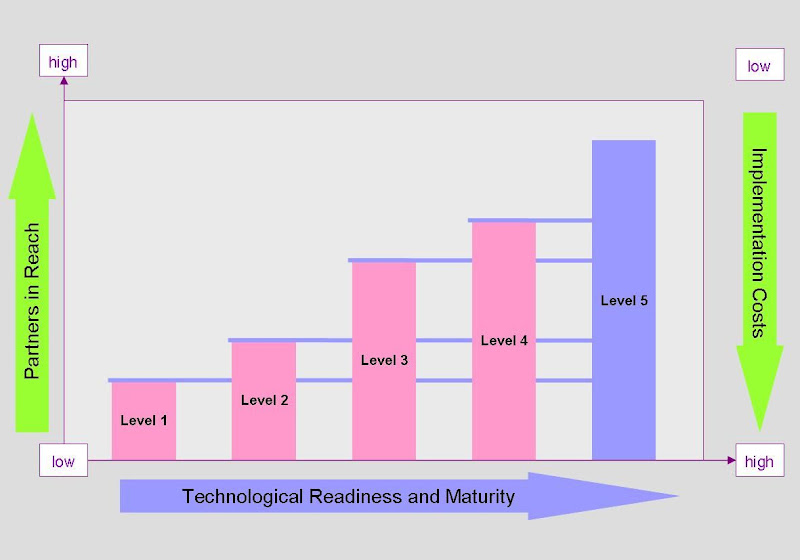

Organizations looking for guidance need to understand that firms on different maturity positions deal differently with adopting e-Business given that some strategies lead to full enablement of their trading partner community reaping high benefits whilst others do not.

The Organizational Readiness of the enterprise forms the starting point for determining the appropriate approach to adopting e-Business. Organizations should prepare to understand the opportunities and challenges arising from the strengths, weaknesses and shortcomings of their technological maturity. Companies should also assess the organizational readiness and willingness of their trading partners.

The positions of organizations on the e-Business Maturity Ladder holds implications and possibilities for targeting e-Business. Most important aspects are the level of technology currently incorporated into business and administrative processes and the adaptive power of the enterprise architecture.

Companies with greater technological maturity and sophistication are better prepared than less mature enterprises. Normally these companies can reap higher benefits – lower investments and faster savings – as they have a larger number of trading partners in reach. Often they only need to strengthen their ability to communicate and collaborate by leveraging the interoperability and integration capabilities of their systems and applications. These companies should strive to attain full enablement of their trading partners by providing multiple communication and collaboration channels as part of a multi-channel approach.

A typical multi-channel approach builds on the logic that electronic business documents – structured files containing data – can be transformed into any format and presented / communicated via several means, including paper and mail, whilst processing of unstructured files is also supported via scanning and OCR techniques.

Companies that have a high technological readiness and adhere a multi-channel strategy are better prepared to reach all of their trading partners as can be seen hereafter.

These companies are ready to enable e-Business with all of their trading partners also those who still work with paper.

The state of technological readiness of firms depends on the maturity of their enterprise architecture. Higher maturity levels have significant and positive impact on adoption of e-Business since they require none or low investment to engage in cross-enterprise communication and collaboration.

Yet the adaptive power of enterprise architectures may enable less mature companies to achieve positive results at reasonable costs. An adaptive dynamic enterprise architecture builds on design principles such as modularity, componentization, reusability and standardization that permit firms to rapidly increase their maturity level.

However companies not necessarily need to invest in increasing their maturity if all of their trading partners have a lower maturity level. Depending on the maturity of their trading partners companies could even sustain

The Organizational Readiness level of the enterprise forms the starting point for determining the most appropriate and cost-effective approach to adopting e-Business.

Organizations should prepare to understand the opportunities and challenges arising from the strengths and weaknesses of their current technological maturity when determining their future direction. The current position on the e-Business Maturity Ladder incorporates certain implications and possibilities.

Apart from their own internal technological readiness companies should carefully evaluate their external environment and take into account the technological capabilities of their trading partners.

In general companies with greater technological maturity and sophistication can reap higher benefits for they have a larger number of trading partners in reach than the less mature enterprises. These companies should leverage the interoperability and integration elements of their systems and applications to enable multi-channel network connectivity and interaction.

The multi-channel approach builds on the concept that electronic documents – structured files containing data – can be transformed into any format and presented or communicated via several means, including paper and mail, while processing of unstructured data is also supported using scanning and OCR techniques.

When customers or suppliers are able to send and receive business documents in any format using any means they can reach all of their trading partners almost in real-time.

Understanding the factors driving and inhibiting infusion

In that respect companies should take into account the readiness of their trading partners.

While adoption refers to the actions taking by a single firm it is important to realize that adoption by several firms, customers or suppliers, brings real value. Greater diffusion or “wide-spread adoption” of e-Business delivers higher benefits and a better Return on Investment.

Forming an attitude toward adoption

Once decision-makers understand the position of their company and their partners they are able to define their goals and ambitions.

“Awareness of what is and understanding of what is possible leads to envisioning where to be!”

Tags van Technorati: e-Invoicing,e-Business

Last update: 26-11-2011